This week, Tesla shares went on a bit of a burn. The company’s market value went up by more than $A125 billion in a single day, on Monday, when the stock jumped 10% after an important raise from one of the top analysts in the car industry.

Adam Jonas has been in charge of Morgan Stanley for a long time, and for many years he has been able to give some of the best information about the switch to electric cars led by Tesla and what it means for the whole car business. But until now, it was mostly skeptical about the idea of robot taxis and cars that drive themselves.

All of that changed this week when a thorough report on Dojo, Tesla’s in-house supercomputer, came out. This was a huge change in how much the company could be worth.

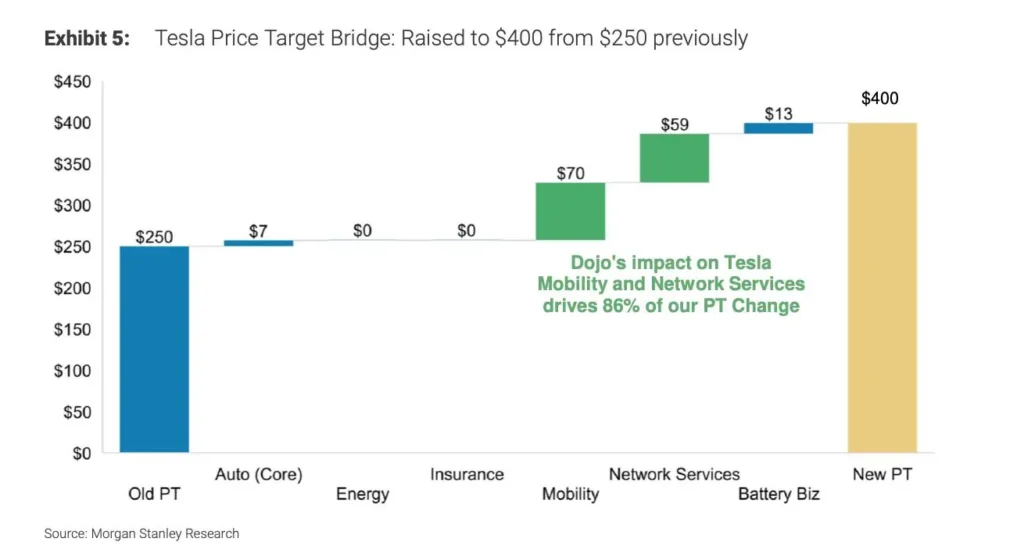

Jonas has raised his goal price for Tesla shares from $US250 to $US400, which would give the company a market capitalization of about $US1.3 trillion ($A2 trillion). Jonas also has a “bull case” stock price goal of $US550 per share, so things could get even better.

On Monday, the company’s stock price reacted by going up, ending the day at $US273 per share.

Read More: Apple’s $5 Million Book Payment Proves Bankman-Fried’s Enterprise

Why did it happen?

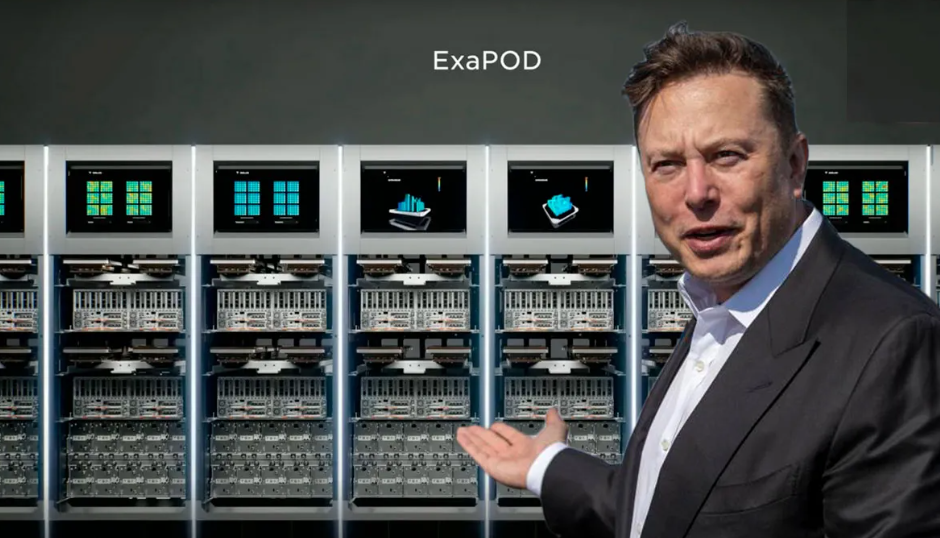

It’s all about Dojo, the in-house supercomputer that Morgan Stanley says could speed up the adoption of robotic cars, something the investment bank had been cautious about until now.

It will also improve something called “network services,” which is mostly about letting other companies use its hardware and includes autonomy, charging, support, and upgrades.

What is Dojo, though? Why did things change?

Dojo is a supercomputer that Tesla built in-house to train its computer vision systems. “Dojo” is short. Besides the Optimus Humanoid, Elon Musk’s preoccupation with Tesla’s Full Self Driving (FSD) technology is a major factor.

Tesla spends at least $1 billion every year on research and development. More importantly, it has data from Tesla EVs that have driven hundreds of millions of miles around the world.

“Tesla cars are robots with sensors all over them that make life-or-death decisions in environments and situations that are hard to predict,” the investment bank team says.

Tesla’s ability to collect, label, and process real-world video data from the edge and train these robots from the experience of its fleet in service, which is 5 million units today and will be closer to 50 million by the end of the decade, limits its ability to improve its full self-driving (FSD) system.”

It says that Tesla has put together a very experienced semiconductor team and built a custom AI ASIC chip that can work more efficiently (in terms of energy use and latency) than the most advanced general-purpose chips on the market from Nvidia, and possibly at a fraction of the cost.

Read More: TikTok Partners with Billboard to Launch Top 50 Chart

Morgan Stanley Writes

Morgan Stanley writes, “We think Dojo could be the next big change in how the market sees Tesla.”

“Dojo puts the spotlight on three of Tesla’s most important strengths: 1) speed, 2) ability, and 3) price. In the near future, we think that Dojo can speed up the growth of Tesla’s software and services business and help it make money.

“In the long run, we think Dojo could make it possible for Tesla’s software and hardware to be used outside of the auto business. What other markets could open up if Dojo can help make cars “see” and “react”? Think of any gadget on the edge that has a camera and makes decisions in real time based on what it sees.

Jonas and his team name it the “Muskonomy” because it works for Twitter/X, SpaceX, and batteries.

When it comes to electric vehicles (EVs), the growth of Dojo puts Tesla at the center of the global industry. Other car companies rely on Tesla for licencing charging and FSD hardware, as well as battery knowledge.

What do analysts write?

Analysts write, “The more we looked at Dojo, the more we saw that the stock could have a value that wasn’t being fully recognized.”

“Tesla is not the first tech company to try to make its own custom silicon system. What makes Tesla special is that the company has been making advanced driver assistance systems (ADAS) for a long time.

“It has turned a huge network of cars into a business. There are already more than 400k FSDs on the road collecting data from more than 300 million miles driven. The company has also put together a world-class design team and put a lot of money and time into solving the problem of autonomy.

“Even though it’s hard to prove Tesla’s many claims about Dojo’s price and performance, we think the company has a chance of coming up with a competitive unique solution, given its history of innovation and its ability to do so.