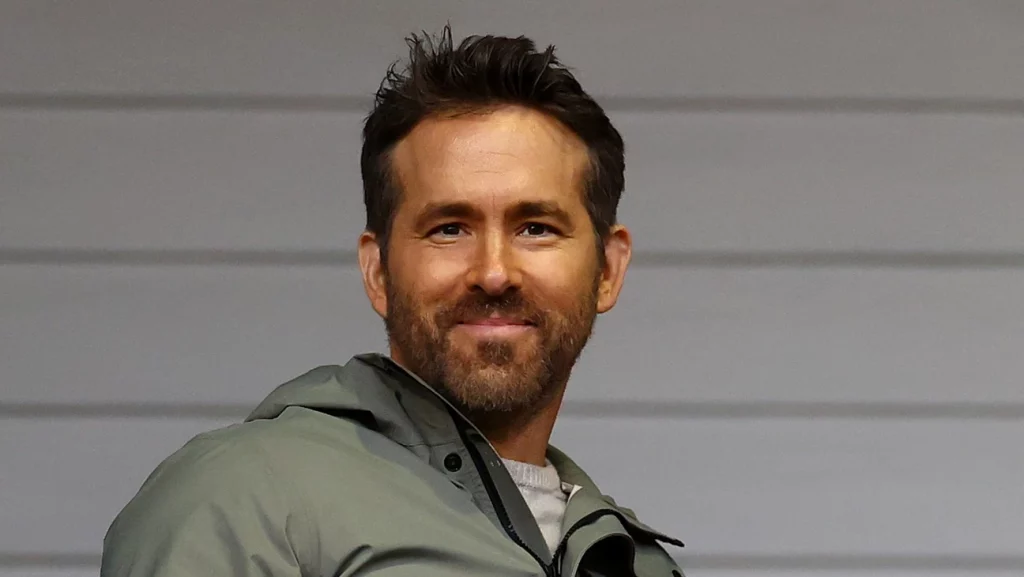

The latest famous person to see a business endeavor bear fruit in the form of a sizable acquisition is actor Ryan Reynolds. On Wednesday, T-Mobile (TMUS), an established carrier, completed its acquisition of Mint Mobile, a startup backed by Reynolds, for $1.35 billion.

The purchase price is split 61% into shares and 39% into cash. According to Mint Mobile co-founder David Glickman, Reynolds, who owns a minority stake in the company, plans to “continue for years” as the service provider’s public face.

“We are so happy T-Mobile beat out an aggressive last-minute bid from my mom Tammy Reynolds as we believe the excellence of their 5G network will provide a better strategic fit than my mom’s slightly-above-average mahjong skills,” Reynolds said jokingly in a statement.

Major corporations’ investments in celebrity-backed businesses are nothing new.

Many other well-known people who owned sizable privately held businesses, especially in the booze and cosmetics industries, have sold out to larger conglomerates.

Take a look at some of the acquisitions that have taken place recently:

Aviation Gin and Reynolds

Celebrity booze brands gained popularity during the pandemic years and have since seen strong sales.

Furthermore, most famous people continue to serve as the company’s public face even after being bought out.

Reynolds has been instrumental in promoting Aviation Gin, a high-end alcoholic beverage that will be acquired by Diageo (DEO) in 2020 for $610 million.

In spite of the fact that the agreement included “an ongoing ownership interest” for both parties, Reynolds did not invent Aviation Gin. In 2018, he became a co-owner and has since promoted the gin on talk shows and in his “Deadpool” superhero film.

In his words, “Aviation is, hands down, the best,” Reynolds claims to have tried every gin in the world. Furthermore, I do not suggest sampling every gin in existence. Please, don’t leave us here.