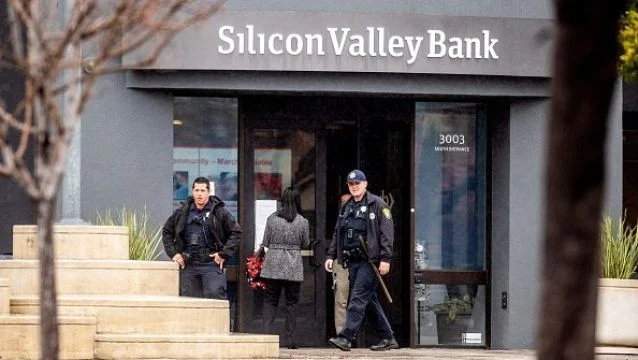

Thousands of British technology companies had their funds at the defunct Silicon Valley Bank, which has now been acquired by HSBC.

After the shocking failure of its parent company in the United States, the Bank of England was prepared to declare SVB UK insolvent if a buyer hadn’t been found. With the bank’s insolvency, customers would have only had their deposits up to £85,000 ($100,000) or £170,000 ($200,000) for joint accounts protected.

The central bank issued a statement reassuring customers that their funds deposited with SVB UK would remain secure following the deal.

The £1 ($1.2) deal, announced by Europe’s largest bank HSBC early on Monday morning, is set to go into effect “immediately.”

To quote the head of money and markets at an investment platform, “the acquisition should end the nightmare thousands of tech firms had been experiencing over the past days,” Susannah Streeter.

Tech executives in Britain

Tech executives in Britain were scrambling to figure out how to get their money out after the failure of SVB UK, a major bank partner for the sector.

Piotr Pisarz, CEO of the financial technology startup Uncapped, which lends money to other startups, called HSBC’s rescue “fantastic news” for the UK startup ecosystem. We can all take it easy today,” he told CNN.

On Saturday, Uncapped introduced a new emergency funding program to assist businesses in making payroll and other timely payments. Pisarz, who said on Monday that the organization was ready to help companies hit by the SVB collapse, said the organization had received “hundreds” of applications from businesses in the United Kingdom and the United States. Longer-term bridge loans to supplement working capital are also available from Uncapped.

Pisarz predicted that this would lead startups to seek out additional banking options. Half of Britain’s startup ecosystem banking with one institution was “unhealthy,” he said.

Following the acquisition, HSBC CEO Noel Quinn issued a statement assuring SVB UK customers that their deposits were “backed by the strength, safety, and security of HSBC.”

This purchase is a great strategic fit for our company in the UK, he said. To quote the company’s CEO: “It strengthens our commercial banking franchise and enhances our ability to serve innovative and fast-growing firms, including in the technology and life science sectors, in the UK and internationally.”

The Fall in Bank Stocks

Shares of HSBC listed in London opened the day down 3.6%. Trading down 5.6 percentage points was the Stoxx Europe 600 banking index, which follows 42 major European Union and UK banks.

British Finance Minister Jeremy Hunt issued a statement to the international community assuring them of the stability of the British banking system.

The UK’s “financial stability was never at risk,” he assured reporters. The financial system in the United Kingdom is safe and sound because of its high capitalization.

According to HSBC’s statement, as of last Friday, SVB UK had deposits of around £6.7 billion ($8.1 billion) and loans of around £5.5 billion ($6.7 billion). Its most recent fiscal year ended in December, and it posted a pretax profit of £88 million ($106.5 million).

In the United States last week, a huge bank run was sparked by worries about the liquidity of SVB, a lender known for financing startups. On Friday, it collapsed, making it the second-largest financial institution to fail in the United States.

U.S. financial regulators moved quickly over the weekend in response to fears of a domino effect, assuring customers of the failed bank that they would have full access to their funds beginning Monday.

Signature Bank was a regional US bank that had been closed by regulators due to financial difficulties, and its customers have been given a government guarantee on their deposits.