As it attempts to repay creditors, customers, and investors, the crypto exchange will appoint a new CEO.

Crypto is a disaster. The year 2022 got even worse when FTX (along with its international platform, the independent FTX.us exchange, and Alameda Research), previously the world’s third-largest crypto exchange by volume, couldn’t come up with the funds to meet customers’ withdrawal requests and then experienced an unsuccessful acquisition attempt by a competitor.

Now, the company is declaring Chapter 11 bankruptcy in the United States and announcing the resignation of founder and CEO Sam Bankman-Fried. The bankruptcy filing itself is now available (pdf), and it lists a total of 134 corporate entities included in today’s announcement, as well as the appointment of crypto investor Stephen Neal as chairman of the board for FTX and Alameda.

Read more: FTX is on the Verge of Collapse After a “Liquidity Constraint” at a Cryptocurrency Exchange

The ripple effect across the industry began last night, when Blockfi, another crypto services firm, froze customer withdrawals due to the FTX issues. Following the announcement, the price of Bitcoin fell sharply before recovering slightly remaining below $17,000.

According to Bloomberg, Bankman-personal Fried’s assets peaked at around $26 billion in March of this year before plummeting from a reported $16 billion to zero in just a few days. The Wall Street Journal and Reuters reported yesterday that the founder, known as SBF, had used $10 billion in exchange customer funds to support his other crypto business, Alameda Research.

SBF stated in a series of tweets, “I fucked up, and should have done better,” without elaborating on how the shortfall occurred.

“I was shocked to see things unravel the way they did earlier this week,” SBF said in a thread posted today. I’ll write a more detailed post on the play-by-play soon, but I want to make sure I get it right.”

A liquidity crunch triggered by CoinDesk’s report on the arrangement, as well as a statement from Binance founder Changpeng Zhao saying he planned to sell his cache of FTX’s crypto token, resulted in a liquidity crunch that exposed an $8 billion hole in the beleaguered company’s balance sheet.

Update:

FTX, FTX US, Alameda Research and around 130 other companies have filed for Chapter 11 bankruptcy protection in the US, the group announced Friday. While it remains unclear how much capital VC investors will receive after the proceedings, the event could rank as the largest capital loss in VC history, given the $2.4 billion that FTX and FTX US had raised from investors. (Nov. 11, 2022)

FTX, one of the largest global crypto exchanges, faces insolvency risk as it halted customer withdrawals earlier this week. Right before the stoppage, FTX experienced a classic “bank run” where roughly $5 billion in withdrawals were requested, 50 times its average daily net in/out flows.

Binance, arguably FTX’s biggest competitor, announced a day after the halt that it had entered into a non-binding agreement to acquire FTX, but after a short period of due diligence, Binance announced they will not proceed with the acquisition, leaving FTX to seek other financing.

Many questions remain, but it seems likely that FTX could collapse in what would be a historic failure for a VC-backed company that was considered an industry leader. The immediate question is whether FTX can find financing partners able to fill a multibillion-dollar gap on its balance sheet. Regardless of the outcome, the event could accelerate a retreat from VC investment in the crypto sector.

FTX Backstory

In August 2019, FTX raised an $8 million seed round in which Binance participated. Later in 2019 Binance also participated in FTX’s Series A and announced a strategic partnership between the two exchanges. Binance received equity and the FTX native token, FTT, as part of its investment.

At the time, FTX founder and CEO Sam Bankman-Fried said in a press release that “the investment will help accelerate the growth of FTX with support and strategic advisory from Binance while FTX maintains its independent operations.”

Since then, FTX has grown to become one of the preeminent spot and derivatives crypto exchanges and a formidable challenger to Binance. In early 2022, Binance exited its equity position in FTX, while continuing to hold FTT, by selling to hedge fund Alameda Research for $2.1 billion in cash and FTT.

On Nov. 2, CoinDesk reported that Alameda, a firm also founded by Bankman-Fried, had assets that largely consisted of FTT tokens. This suggests some weakness in the hedge fund’s capital structure as it comprises mainly of a token issued by an entity in which an arm’s-length relationship was expected. Potentially on that news, Binance founder and CEO Changpeng Zhao publicly announced that the company is planning to completely exit all FTT positions. The announcement shook market confidence in FTX, leading to a simultaneous influx of redemption requests for clients’ funds and an intense sell pressure on FTT.

The Unknowns

We don’t know specifically why FTX is facing a liquidity crisis and could potentially be insolvent. Although client funds on the exchange should be fully kept on a one-to-one basis with crypto custodians, this does not seem to be the case, as FTX cannot fulfill redemptions.

Bankman-Fried told investors earlier this week that FTX has lent Alameda around $10 billion, according to The Wall Street Journal. The cozy relationship with Alameda suggests that some of these loans could be composed of clients’ assets. Alameda notably seemed unaffected by the $45 billion collapse of Terra’s Luna ecosystem in May 2022—while many hedge funds and crypto companies such as Three Arrows Capital, Arca Funds, Celsius and Voyager Digital were severely impacted. An influx of capital from FTX would certainly help soften any adverse impact to Alameda from Luna’s collapse. It’s possible that the broader crypto crash weakened Alameda to the point where it needed outside support.

Meanwhile, over the past couple months, both FTX and Alameda deployed significant amounts of capital to rescue embattled crypto companies Voyager and BlockFi. FTX Ventures and Alameda have continued to make VC investments and were involved in 34 deals since June 1, according to PitchBook data. FTX also scooped up a 7.6% stake in stock brokerage Robinhood and is reportedly an LP in multiple venture funds. We don’t know if any or what portion of client funds were used in part of these capital deployment strategies.

While Bankman-Fried said in a tweet Thursday that “FTX … currently has a total market value of assets/collateral higher than client deposits,” the large unknown is the composition of its assets. We don’t know if any are illiquid and if any have lost value based on the investment activities mentioned above, should it involve client funds. Similarly, we also do not know the makeup of the collateral. If any significant portion of the collateral is in FTT, as some have reported, then its value has severely diminished. FTT is now trading at $2 per token, down from $25.

What Might Happen Next

This is a fast-moving situation, so details will change. FTX is rumored to have a $6 billion to $10 billion gap in the amount between liquid assets available and total client assets. This amount may be too large for any financing partners to plug. If the capital hole is significantly smaller, we believe that investors would consider a rescue. The key question is how big FTX’s capital hole is and whether Bankman-Fried can convince investors to support him.

The Bahamas has assigned a “provisional liquidator” to FTX. A reading of the law suggests that insolvent firms enter liquidation, though certain legal sources we have reviewed suggest that a restructuring is possible within the Bahamian legal regime. Investors are now asking questions about FTX US, given the alleged transactions between FTX and Alameda. Bankman-Fried stated in a tweet that FTX and FTX US are two separate entities and that FTX US is not financially impacted, with users able to fully withdraw.

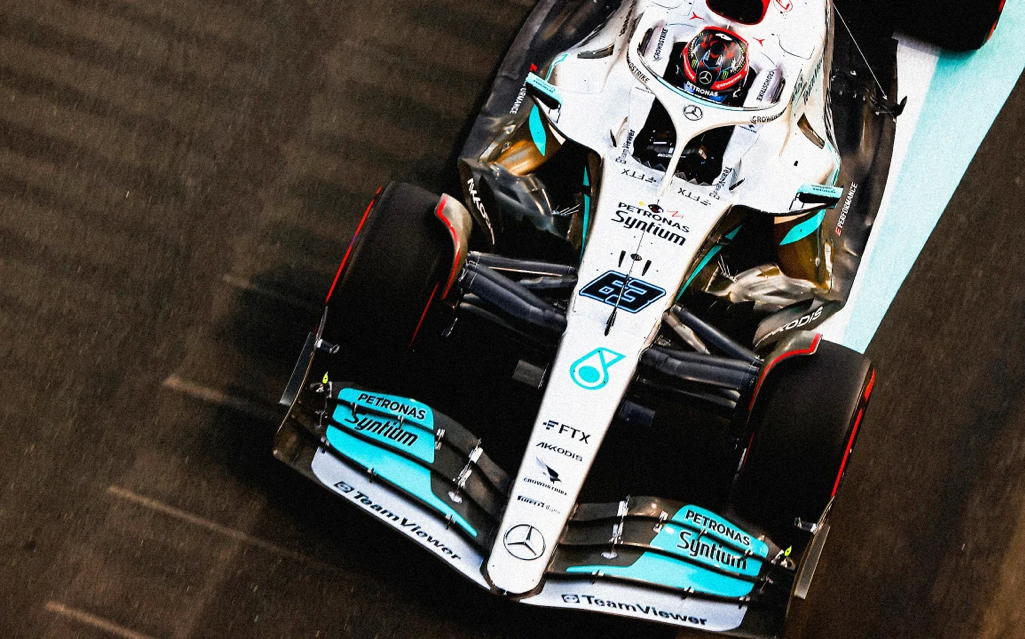

Mercedes Formula One was skeptical of crypto sponsorships. Now it’s racing to drop FTX.

In the wake of a rapidly spiraling crypto crisis, FTX branding will be removed from Mercedes team cars.

The Mercedes Formula One team, home to seven-time world champ Lewis Hamilton, announced it has suspended its partnership agreement with the troubled cryptocurrency exchange FTX.