The Chinese electric vehicle manufacturer NIO has secured a significant $470 million investment to fuel its growth ambitions. As the company prepares to launch its new, lower-cost Onvo brand, this fresh capital injection will provide the necessary resources to accelerate sales and expand its market reach.

NIO Receives Major Cash Boost to Drive Electric Vehicle Expansion

NIO China, a subsidiary of NIO, announced on Sunday that it has received a significant cash injection of RMB 3.3 billion ($470 million) from three investors. The funding will be used to support the company’s growth and expansion plans.

Hefei Jianheng New Energy Automobile Investment Fund Partnership, Anhui Provincial Emerging Industry Investment Co, and GS Capital will be investing in NIO China for newly issued shares. The investment will be made in two installments: 70% by the end of November 2024 and the remaining 30% by the end of December 2024.

NIO said it has long-term advantages. However, following the transaction, NIO’s ownership of NIO China will decrease from 92.1% to 88.3%.

Furthermore, NIO’s parent company can invest an additional RMB 20 billion ($2.9 billion) in NIO China by December 31, 2025. This extra investment could further bolster the company’s growth and development.

Read More: F1 Teams Worth Billions: Cost Cap Revolutionizes the Sport

NIO stock is on the rise

NIO will utilize the recently secured cash investment to support its ambitious multi-brand strategy, expand its market reach, and drive sustained growth. The new Onvo brand, launched with the L60, is expected to play a significant role.

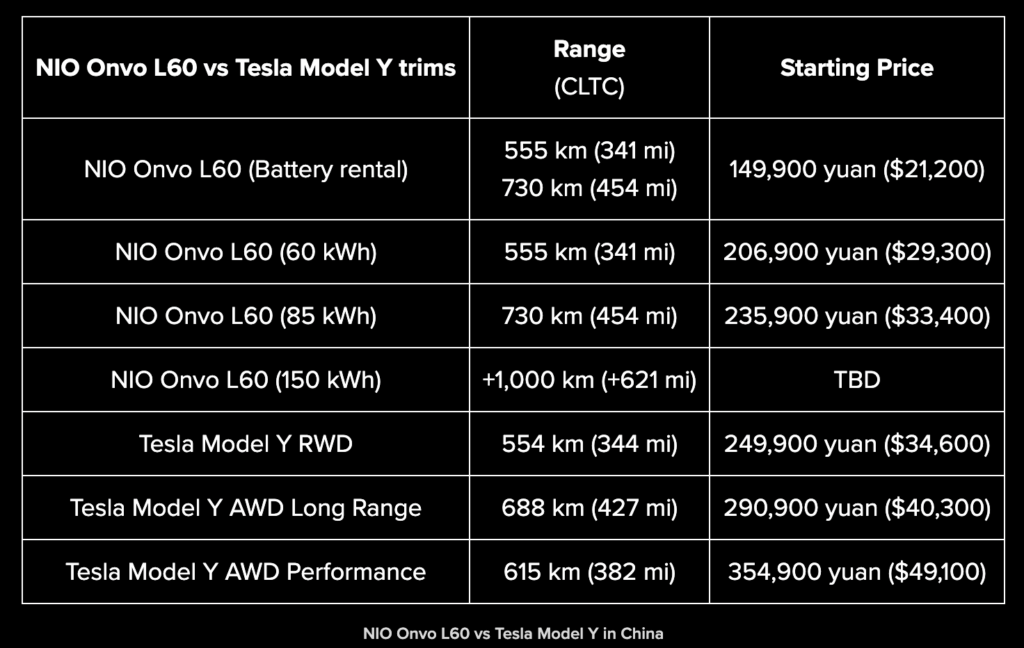

The L60, priced at $21,200, is poised to compete directly with Tesla’s popular Model Y. This competitive pricing has already fueled a surge in NIO’s stock price, with shares rising over 70% in the past month. However, despite this recent rally, NIO’s stock remains down for the year and significantly below its all-time high.

Following the news of the cash investment, NIO’s stock has seen further gains, trading at just under $7 per share. The launch of the L60 has garnered positive feedback from investors and analysts alike. Deutsche Bank analyst Wang Bin’s team has expressed optimism about the L60’s potential for a “brand revival” based on strong initial dealer feedback. As a result, they have increased their monthly delivery guidance for the L60 to 10,000 units from 8,000.

In a recent research note, Deutsche Bank analyst Wang Bin’s team expressed optimism about NIO’s prospects following the company’s new cash investment. The analysts believe that the funding will alleviate investor concerns regarding potential share dilution and could lead to a positive reaction in NIO’s stock price.

Additionally, NIO’s strong sales momentum continues, with the company delivering over 20,000 vehicles for the fourth consecutive month. This achievement demonstrates NIO’s growing market presence and increasing demand for its electric vehicles.