Shares of Tesla (NASDAQ: TSLA), an electric vehicle manufacturer, have dropped by more than 35% since Tesla CEO Elon Musk revealed his attempt to acquire the social network Twitter. Despite a daily loss of 3.6%, Tesla’s stock closed down just 0.4% on Friday as the market rallied after a turbulent week. In comparison, the Nasdaq Composite has dropped by nearly 18% during the same time period.

On April 25th, 2022, Musk revealed he had reached an agreement to purchase Twitter. His first full week as a Twitter owner culminated with a price of $207.47 per share, down from the $332.67 at which Tesla shares closed the day before.

On Friday, Musk addressed the 29th annual Baron Investment Conference, where he was questioned on his ability to juggle his many roles as CEO of Tesla, SpaceX, and Twitter by hedge fund investor Ron Baron, who is a shareholder in all three companies and is typically bullish on Musk’s ventures.

Read More: Elon Musk Says Twitter is Losing Over $4 Million a Day

Musk is the CEO of SpaceX, a reusable rocket manufacturer, and satellite internet firm; Tesla, a global electric vehicle and sustainable energy company; Neurolink, a brain-chip manufacturer; and The Boring Company, a tunneling business. He also refers to himself as “Chief Twit.” More formally, after his $44 billion deal, he is Twitter’s CEO and sole director.

The CEO of SpaceX and Tesla told Baron, “My workload went up from, I don’t know, 78 hours a week to probably 120,” before adding, “Once Twitter is put on the right path, I think it is a far easier thing to manage than SpaceX or Tesla.”

Although he has assured his Twitter fans that his time at the helm as Twitter’s sole director and CEO is brief, he has not revealed his successor.

Several major automakers, including General Motors and Audi, have temporarily suspended their social media advertising due to Musk’s ownership of the platform. Though its long-term effects on Tesla remain unclear.

Elon Musk uses Twitter to promote all of his businesses, their products, and his personal image for free, and Tesla has relied on Twitter and Musk’s enormous following there to convey information to shareholders for a long time. On Twitter, he often encourages his followers to attack those they consider Tesla’s adversaries, including lawmakers, authorities like the Securities and Exchange Commission, journalists, and advocates for vehicle safety.

Read More: Terminated at Six Months’ pregnancy, the Twitter Employee says, “See you in Court.”

Over fifty of Musk’s Tesla workers, mostly Autopilot and other software engineers, plus a number of trusted advisors and backers from his other enterprises, have been given access to administer his Twitter account. He hasn’t spoken much about how Twitter and Tesla would compensate workers or how their duties would connect to each other in terms of time commitment.

Musk also said at the meeting with investors that Tesla still wants to make an electric car that costs less than the Model 3. A daily output of 40,000 automobiles was also mentioned again.

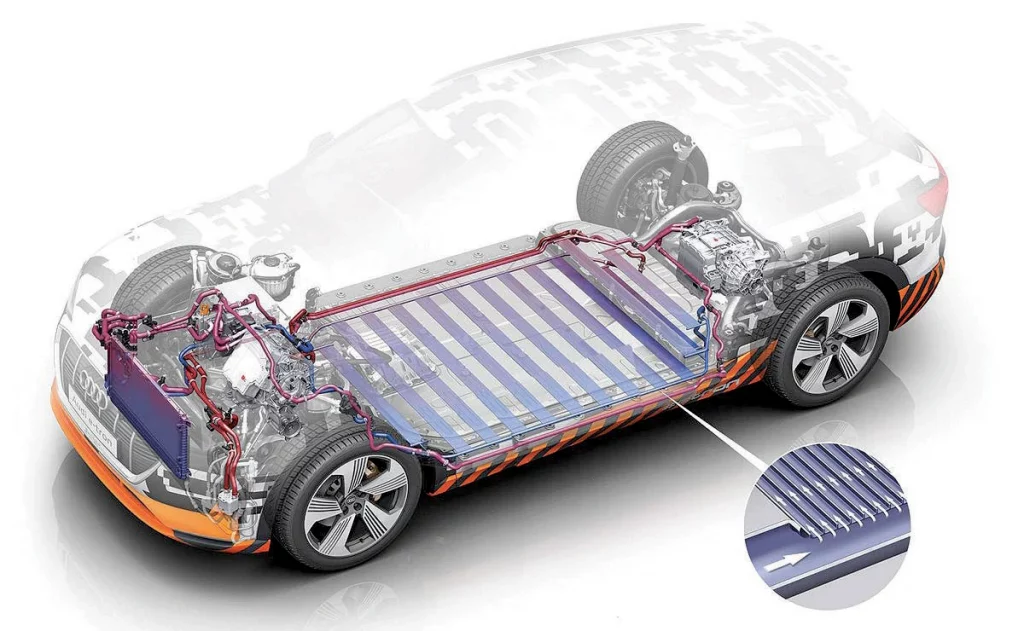

Musk added that it is increasingly likely that Tesla will need to be directly involved in mining rather than depending only on outside suppliers due to the large number of batteries and other minerals needed for this level of manufacturing.

In light of reports that Tesla was in talks with Glencore or considering making an investment in the company, Baron wanted to know if this was true. In regards to lithium mining, Musk underlined, “I’m talking about Tesla, doing it ourselves.” He added, “We’ve never discussed investing in Glencore.”

Since Musk announced the acquisition in April, Tesla’s stock price has dropped a lot compared to other automakers. Electric vehicle manufacturer Rivian is down a little over 5%, while General Motors and Ford are down roughly 2% and 11%, respectively.