Zacks.com’s most-searched stocks feature Tesla (TSLA) as of late. As a result, you may want to think about some of the most important aspects that may affect the stock’s performance in the next months.

Shares of this electric vehicle manufacturer have lost 8.1% over the past month, lagging behind the 1.2% gain seen by the Zacks S&P 500 index. It’s no secret that the automotive business is one of the fastest-growing industries in the world.

There are always some basic variables that drive the buy-and-hold choice, even while media reports or rumors about a big change in a company’s business prospects usually cause its stock to trend and lead to an abrupt price change.

Earnings Estimate Revisions

Zacks places a premium on analyzing the variance in profit forecasts over all other factors. This is because we think the present value of its future stream of earnings establishes the fair value for its stock.

Simply put, we analyze how sell-side analysts who follow the stock are adjusting their profit forecasts to account for the effects of the most recent developments in the company’s industry. And if a company’s expected earnings go up, so does the value of its shares. When the stock’s fair value is higher than its present market price, investors become more enthusiastic about purchasing it, pushing the stock’s price upward. For this reason, empirical studies have found a robust association between long-term trends in earnings estimate revisions and short-term stock price changes.

Compared to the same period last year, analysts predict a +10.5% increase in quarterly earnings for Tesla, to $0.84 per share. Over the past 30 days, there has been a -11.1 percent shift in the Zacks Consensus Estimate.

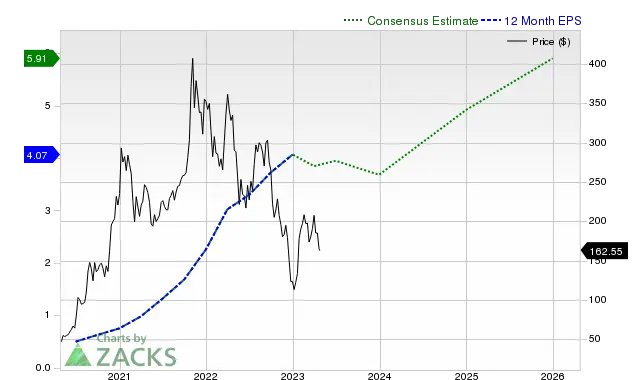

Current consensus profits projection (Tesla)

The current consensus profits projection for the fiscal year is $3.62, which is down 11.1% from last year. This forecast has moved -8% in the past month.

The consensus earnings estimate for Tesla’s next fiscal year is $4.80, which is up 32.5% over the earnings forecast for the same period last year. The prediction has moved -6.1 percentage points in the previous month.

Our Zacks Rank, a proprietary stock rating technique that efficiently harnesses the power of earnings estimate revisions, has a proven track record and provides a clearer sense of a stock’s price direction in the near term. Tesla has a Zacks Rank #3 (Hold) due to the size of the recent shift in the consensus estimate and three other variables relating to earnings estimates.

See how the consensus EPS forecast for the next 12 months has changed for this company in the chart below.

12 Month EPS

Projection of Increasing Sales

Nothing occurs if a company can’t increase its revenues, even if earnings growth is likely the best sign of its financial health. Increasing profits without increasing sales is extremely difficult for established businesses. Therefore, it is essential to estimate a company’s future revenue growth.

For the current quarter, analysts predict that Tesla’s revenue will be $24.4 billion, representing a growth of 44.1% year over year. The projected $99.41 billion for the current fiscal year and the projected $124.89 billion for the following fiscal year represent increases of +22% and +25.6%, respectively.

Last Reported Results and Surprise History (Tesla)

In the most recent reported quarter, Tesla’s revenues totaled $23.33 billion, a +24.4% increase year over year. Earnings per share were $0.85, down from $1.07 at the same time last year.

The reported revenues constitute a surprise of -1.11% when compared to the Zacks Consensus Estimate of $23.59 billion. There was a +2.41% EPS surprise.

In each of the previous four quarters, the company’s earnings per share (EPS) exceeded analyst projections. Only once throughout this time period did corporate revenue come in higher than expected.

Valuation (Tesla)

Without knowing how much a stock is worth, investors can’t make an informed decision. The future price performance of a stock is heavily dependent on whether or not the current price accurately reflects the intrinsic worth of the underlying business and the growth prospects of the firm.

When determining whether a stock is fairly valued, overvalued, or undervalued, it is helpful to compare the current values of a company’s valuation multiples such as price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF) with the company’s own historical values.

The Zacks Value Style Score, part of the Zacks Style Scores system, ranks stocks from A (best) to F (worst) on a scale from one to five, with higher scores indicating higher valuation and lower scores indicating temporary undervaluation or overvaluation.

Tesla receives a C here because its pricing is comparable to its competitors. To view the weighted average of the valuation indicators used to determine this grade, please click here.

Conclusion

Whether or whether it’s worth paying attention to the market buzz regarding Tesla can be determined with the help of the data provided here and much other material on Zacks.com. However, the company’s Zacks Rank #3 suggests it could eventually match the market’s performance in the near future.