SoftBank’s Vision Fund, the world’s largest technology investment fund, lost $32 billion in the financial year ending March 2023. The loss is the largest ever for the fund, and it comes amid a broader decline in tech valuations.

The Vision Fund’s losses were driven by a number of factors, including a decline in the value of its public portfolio companies and a slowdown in the pace of new investments. The fund’s public portfolio companies, which include DoorDash, Uber, and WeWork, have all seen their valuations decline in recent months. In addition, the fund has been more cautious about investing in new startups, making just 25 deals in the past 12 months.

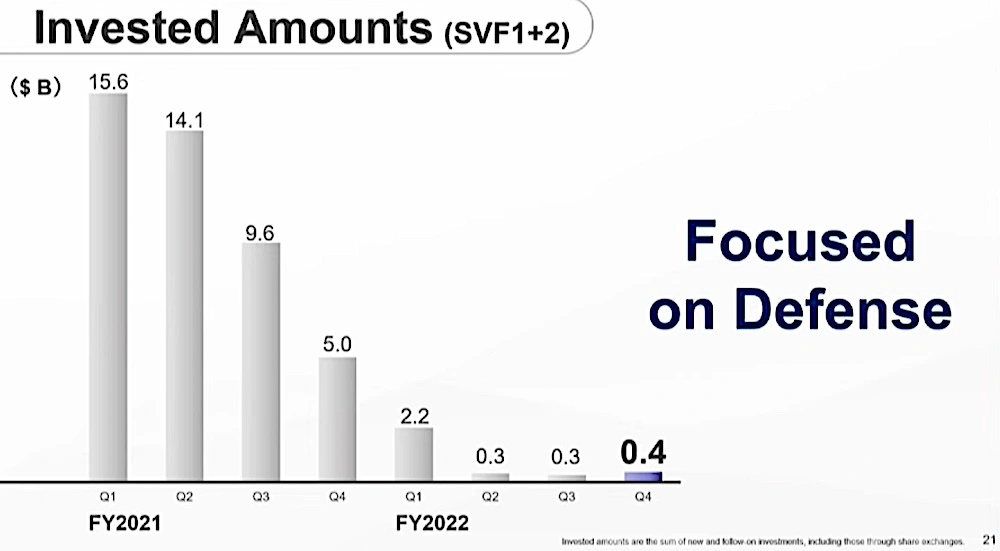

SoftBank Vision Funds’ investments over the past two years. (Image credits: SoftBank Group)

The Vision Fund’s losses are a sign of the broader challenges facing the tech industry. Tech valuations have been declining for several months, as investors have become more concerned about rising interest rates and a potential recession. In addition, the war in Ukraine has also weighed on tech stocks.

Read More: Apple’s $1 billion annual investment in movies should lead to more releases in theatres

Despite the challenges, SoftBank CEO Masayoshi Son remains optimistic about the long-term prospects of the tech industry. He has said that he believes the Vision Fund will eventually be profitable, and he has hinted that the fund could raise a third fund in the future.

However, in the near term, the Vision Fund is likely to face continued challenges. The tech industry is facing a number of headwinds, and it will take time for the fund to recover from its losses.

FAQs

The SoftBank Vision Fund is a $100 billion venture capital fund founded in 2017 by SoftBank Group. It is the world’s largest technology-focused investment fund. The fund invests in early-stage technology companies around the world, with a focus on artificial intelligence, robotics, and other emerging technologies.

Companies like DoorDash, Uber, and WeWork are the beneficiaries of the SoftBank Vision Fund.